What is market sentiment?

Market sentiment, also known as investor sentiment, is the phrase used to describe the attitude of investors toward a particular market or security. You may have heard investors say they feel “bullish” or “bearish” toward a particular market before — these are two of the most common words used to describe whether or not that market is expected to move up or down.

It can be helpful to understand what market sentiment is, particularly if you’re a new investor. Correctly gauging how other, more experienced investors feel about a certain market, security, or cryptocurrency can help you avoid missing out on some profitable investments, or losing your hard-earned cash on badly timed moves.

In this AAG Academy guide, we’ll look at what market sentiment is and why it’s important.

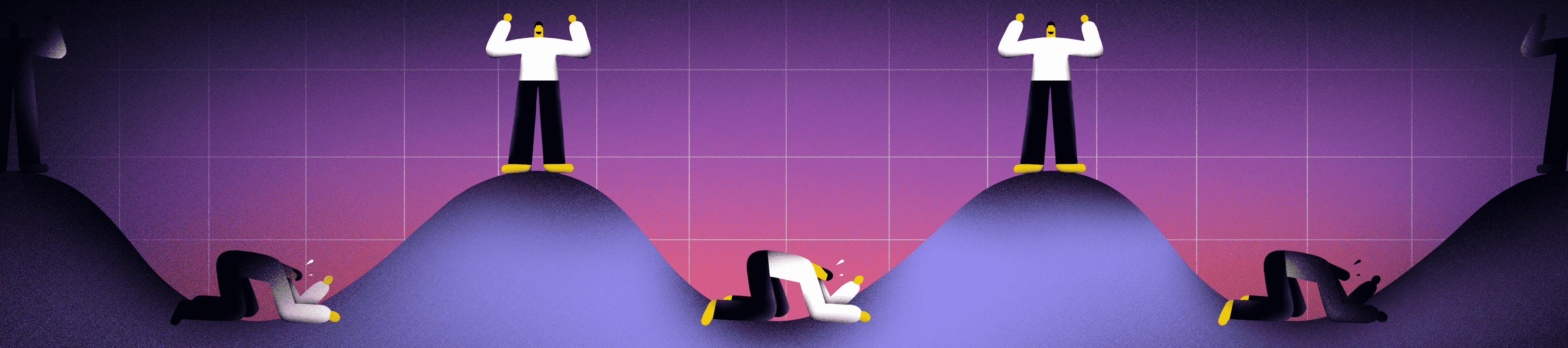

When a particular market or security sees a rise or fall in value, it is rarely a complete surprise. Seasoned investors can often tell when an upturn or downturn is on the horizon, and they will therefore be optimistic (bullish) or pessimistic (bearish) in their approach. This, in a nutshell, is what we refer to as market sentiment.

Knowing and understanding market sentiment has its advantages for investors — particularly those who are new to trading. It can help you better evaluate an asset before you put your own money into it (or take money out of it), and in turn, help you determine whether or not certain moves are going to pay off for you in the long run.

Let’s say, for instance, that you have some extra cash and you want to invest it into a cryptocurrency with the hope of earning a profit over the next six months. A certain cryptocurrency has caught your eye, but while researching it, you’ve discovered that other investors expect its value to drop in the near future.

It would be a bad idea to go ahead with an investment at that time since it would appear that any cryptocurrency you obtain will soon be worth less. Although no one can be entirely certain how things will play out, investors can make educated guesses based on the moves a certain company or project is making, or the state of the market as a whole.

It is also worth bearing in mind that market sentiment often drives demand, which can lead to price movements all by itself. If investors or market watchers feel bullish about a certain security and put their own money into it, this encourages others to do the same, and eventually, we often see an increase in value as a result.

Indicators to measure market sentiment

Market sentiment indicators represent how investors, traders, and other groups feel about a market. They tell us what kind of activity — or in what direction a market will go — these groups expect in the foreseeable future. There are a number of different indicators we can use to gauge investor sentiment, each of which relays that information in a different way.

This can be a little confusing if you’re new to investing, but it’s also incredibly useful in the long run. It means that you can look to multiple indicators for a better understanding of the market when analyzing future moves.

Here are some of the most common market sentiment indicators:

Advance/decline ratio (ADR)

The advance-decline ratio helps traders determine potential trends, existing trends, and the reversal of such trends by dividing the number of stocks that closed higher against the number of stocks that closed lower than their trading price the previous day, week, or month.

On a standalone basis, the advance-decline ratio may reveal whether the market is overbought or oversold. Looking at the trend of the advance-decline ratio can reveal whether the market is in a bullish or bearish trend.

Upside/downside volume ratio

The upside/downside volume ratio helps determine the momentum or a market by looking at the relationship between the volumes of advancing and declining issues on an exchange. It is somewhat similar to the ADR, except it focuses on volume, rather than value numbers.

TRIN Index

TRIN is a short-term trading tool that measures volatility in the stock market. It represents the relationship between advancing and declining issues by measuring their volume flow. A rising TRIN depicts a weak market and a falling TRIN depicts a strong market. A moving average can be added to smooth the data.

VIX

VIX, which is often referred to as the fear index, is derived from S&P 500 options for the 30 days following the measurement date, with the price of each option representing the market’s expectation of volatility over the coming 30 days. Investors use this indicator to measure the level of risk, fear, or stress in the market when making investment decisions.

Put/call ratio

The put/call ratio is calculated by dividing the number of traded put options by the number of traded call options. If the ratio is 1, it indicates that the number of calls is the same as the number of buyers of puts. Anything above 1 suggests a bearish market, in which traders are buying more puts than calls. A falling ratio that’s below 0.7 suggests a bearish market.

NYSE 52-week high/low

The New York Stock Exchange (NYSE) 52-week high/low index tells us whether a stock is trading at its highest or lowest price over the past 52 weeks. This helps determine the value of a stock, and whether or not it could rise or fall.

NYSE Bullish Percent Index (NYSE BPI)

The Bullish Percent Index (BPI) shows us the number of stocks with bullish patterns based on point and figure charts. An index of 50% indicates a neutral market, while anything above that is a bullish market. A rating of 80% indicates extreme optimism toward the market, while a rating of 20% indicates extreme pessimism.

NYSE 50-, 100- and 200-day moving averages

The 50-, 100-, and 200-day moving averages are trendlines that show the average of 50 days, 100 days, or 200 days of closing prices for a stock, plotted over time. It is used by traders as an effective trend indicator and considered the first line of support in an uptrend or the first line of resistance in a downtrend.

Examples of market sentiment

One of the most recent real-world examples of market sentiment comes from the AAII (American Association of Individual Investors) Sentiment Survey, published on August 18, 2022. It shows that individual investors are incredibly optimistic about the short-term direction of the stock market, with bullish sentiment up 1.2 points to 33.3%. To put that figure in perspective, it is the highest level of optimism recorded since December 30, 2021.

Neutral sentiment is down 1.7 points to 29.5%, while bearish sentiment is up just 0.5 points to 37.2%. The AAII notes that optimism has increased as a result of the rebounding stock market, but some pessimism remains due to inflation, corporate earnings, and the possibility of a recession. Some are also concerned about the ongoing invasion of Ukraine by Russia.

Market sentiment and cryptocurrency

Like any other asset, the price of cryptocurrencies is determined by supply and demand, so market sentiment will always play a role. In fact, market sentiment is even more important when it comes to investing in digital assets since cryptocurrencies are even more susceptible to it. Due to the lack of asset support, cryptocurrencies are more volatile and more defenseless against investor moods and feelings.

But it’s also important to be mindful of where that sentiment is coming from. Cryptocurrency projects will often attract supporters who are bullish no matter what — sometimes in an effort to drive up the price of their own investments, rather than because they believe a project is actually a worthwhile investment with a promising plan.

We only have to look at the last Dogecoin bull run for evidence of that. In May 2021, the price of Dogecoin surged to a new all-time high of 73 cents — up 12,000% from January 2021. It made many investors millionaires almost overnight. The reason for that surge? Market sentiment. Supporters, including high-profile names like Elon Musk, rallied around the token for no real reason other than to rally around it, which led others to do the same.

When researching a cryptocurrency investment, then, it’s important to look to the right sources to gauge market mood. While many will sometimes see a surge in value due to community hype, very few have what’s needed to sustain it.

References

- www.investopedia.com/

- www.tradersmagazine.com/

- en.wikipedia.org/

- www.sciencedirect.com/

- therobusttrader.com/

- www.aaii.com/

Frequently Asked Questions

When traders or investors are expecting the price to move upward, we say the market sentiment is bullish.

When the majority of investors are betting on a downward price movement, we say the market sentiment is bearish.

It’s very important that you understand the nature of the market in which you are trading. Make use of market sentiment indicators — more than one if possible — to gauge investor mood and optimism, and avoid investments that are seen as bad moves. And, most importantly, do not see market optimism as a guarantee that a particular investment will pay off. No one can guarantee how a market will move.

Disclaimer

This article is intended to provide generalized information designed to educate a broad segment of the public; it does not give personalized investment, legal, or other business and professional advice. Before taking any action, you should always consult with your own financial, legal, tax, investment, or other professional for advice on matters that affect you and/or your business.

Get news first

Be the first to get our newsletter full of company, product updates as well as market news.